by Jacques Lemoisson | Sep 27, 2023

Over the past 10 years, some of the world’s richest have more than doubled their investments in apartments globally, with a particularly heavy emphasis on the U.S, Bloomberg reported, citing research from Knight Frank. With oversupply being an issue in the...

by Jacques Lemoisson | Jan 2, 2023

If 2022 was challenging, the new year should keep the tone. We thanks our clients for their trust. Our Global Macro strategy reached 43.89% in 2022, and every day our Global Macro Insight paves the way for our clients, helping them to navigate this complex new...

by Jacques Lemoisson | Jan 2, 2023

Outlook 2023 AN Outlook 2023 FR Share...

by Jacques Lemoisson | Feb 16, 2022

Our Global Macro analysis over the past few months seems relevant. As a preamble, the de-escalation in Ukraine is the work of Russia, confirming my comments yesterday in our Global Macro Insight. The USA is now the only one to gesticulate in the zone. Geopolitical...

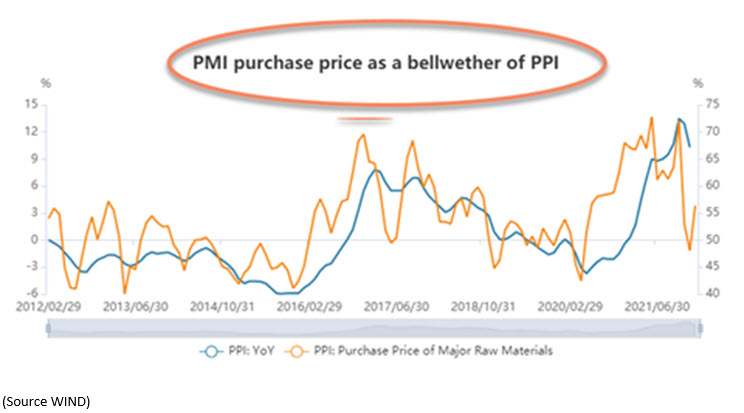

by Jacques Lemoisson | Jun 30, 2021

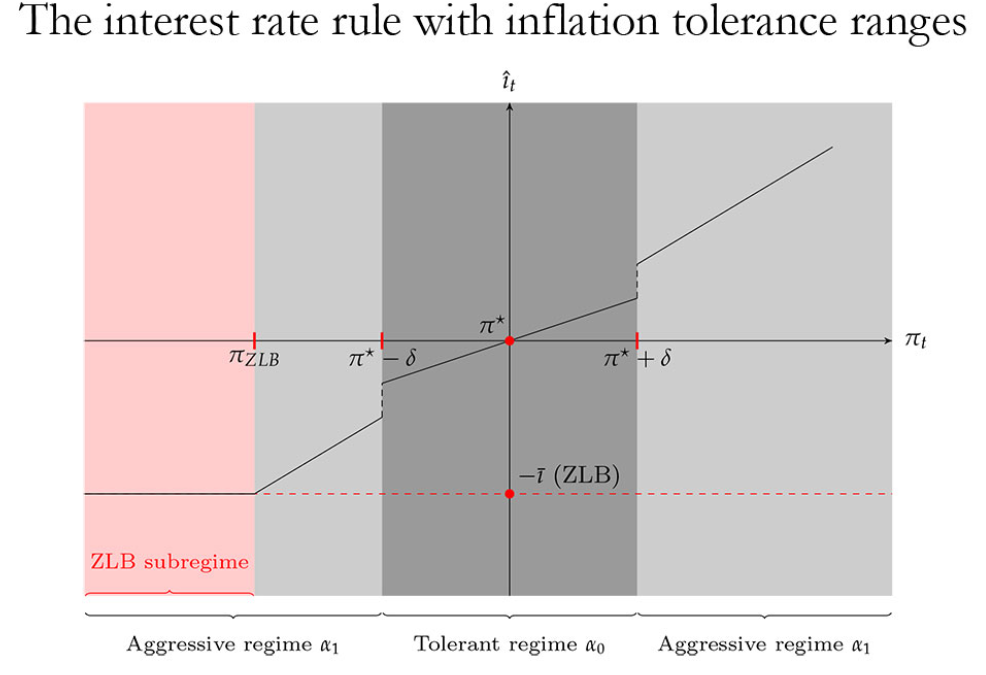

In the field of military operations, my friends in the special forces have always told me that mobility is key, and especially when the situation is perilous. Inaction is often synonymous with injury or worse. Thanks to Jill Cetina (from the FED of Dallas) for having...