About GATE

Capturing the rise of investment thematic with a geopolitical & global macro approach

Our specificity and success are based on our understanding of Geopolitical and Global Macro signals to assess their influences through asset classes, feeding a Quantamental process.

A better understanding of our changing world helps us manage clients’ assets more efficiently with an Independent and Uncorrelated process than traditional financial players.

As a result, our geopolitical approach allows us to :

Look for the Best – Plan for the Worst !

#1

World Economy

Geopolitical interaction due to Trade War, Pandemics, Cyberattacks, etc.

Global trends and their consequences require a holistic approach.

#2

Risks

Dysfunctions are worsening due to Central Bank interventions, volatility, and correlation breakdowns.

New risks must be addressed : natural catastrophes, pandemics, cyberattacks…

Investment and risk management are intrinsic elements that feed our investment approach.

#3

Investors

An investment process needs to be aligned with client values.

Idea generations and portfolio proposals must fulfill the

purpose of the strategy.

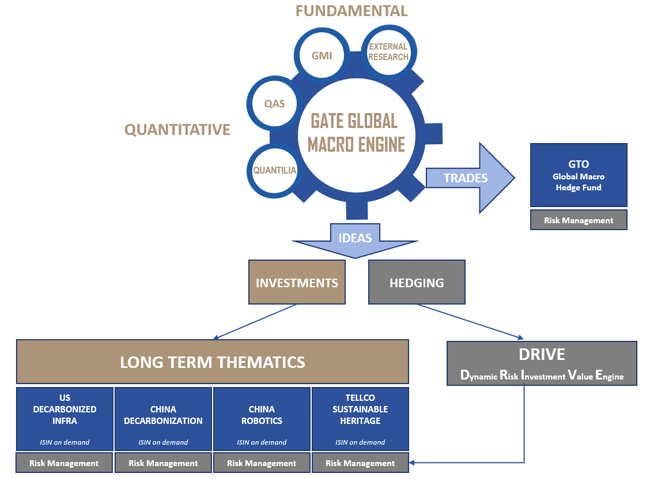

How it Works

GTO : our Keystone

Scalability in Asset Management is possible, like in any other economic sector.

Signals from GTO feed GATE’s investment thematics and hedging processes.

Jacques Lemoisson

Founder of GATE Capital Management

Jacques Lemoisson has managed and advised Global Macro strategies since 2005. He believes in the Quantamental approach. This approach is the combination of a fundamental Global Macro & Top-Down approach, worldwide and cross-assets, and Quantitative processes. Jacques is the author of various Macro newsletters such as the “Global Macro Insight”, reaching out to more than hundreds of institutional investors and thousands of followers including Sovereign Fund, Central Banks and International Organizations.

Strategic partnerships with Quantilia and QAS Inc

GATE has a Quantamental approach combining our fundamental Global Macro & Top-Down views with Quantitative processes.

To build our quantitative framework we decided to collaborate with Quantilia, QAS Inc.